Understanding Checking And Debit Accounts Brochure

Understanding Checking And Debit Accounts Brochure - Checking accounts are a common financial service used by many consumers. Describe what a checking account is. In this assignment, you will create a bank brochure to attract new customers. In this lesson your participants will discover checking accounts—their benefits, how to open an account and use checks and atm cards. Engage in a simulation activity about meeting with a bank or credit union. They can help to manage money and makes paying bills more convenient. Savings and checking accounts are typically the first step in establishing a financial foundation for consumers. A checking account is a type of bank account that allows you to easily access your funds while keeping your money safe. In this lesson, students will explore different payment options, with a focus on using checks. Checking accounts typically come with debit cards and make it easy to withdraw cash through your bank’s atm network. Engage in a simulation activity about meeting with a bank or credit union. These accounts are held at financial institutions that allow you to deposit and. In this lesson your participants will discover checking accounts—their benefits, how to open an account and use checks and atm cards. It’s a convenient way to put money in, make a deposit, take money out… No overdraft feesno minimum balance$0 overdraftsave $200 on fees Checking accounts are a common financial service used by many consumers. However, they generally have low interest rates,. Keeping track of the money in your checking account is easy. In this assignment, you will create a bank brochure to attract new customers. Is to provide information to show that your bank has the best options for a. Savings and checking accounts are typically the first step in establishing a financial foundation for consumers. Checking accounts typically come with debit cards and make it easy to withdraw cash through your bank’s atm network. In this lesson your participants will discover checking accounts—their benefits, how to open an account and use checks and atm cards. This module encourages unbanked. What is a checking account? The purpose of the brochure. Card to a designated bank account expiration date—the debit card is valid and may be until this date cardholder’s name— the cardholder’s full name is written out and. This account can be considered your central financial hub where money comes in and goes out. Savings and checking accounts are typically. Study with quizlet and memorize flashcards containing terms like *which transactions can increase the balance in a checking account? What is a checking account? Checking accounts are a common financial service used by many consumers. It’s a convenient way to put money in, make a deposit, take money out… These accounts are held at financial institutions that allow you to. What is a checking account? Describe what a checking account is. The purpose of the brochure. It’s a convenient way to put money in, make a deposit, take money out… However, they generally have low interest rates,. However, they generally have low interest rates,. Read a text with basic information about checking accounts. They can help to manage money and makes paying bills more convenient. In this assignment, you will create a bank brochure to attract new customers. You can access those funds as long as you. Checking accounts are a common financial service used by many consumers. This account can be considered your central financial hub where money comes in and goes out. The following guide provides a comprehensive overview of everything from how to open a checking account to how to use checks, debit cards, and automatic teller machines. The purpose of the brochure. No. A checking account is a type of bank account that allows you to manage your money for everyday spending. Volumes in this series take the guesswork out of financial planning—how to manage a checking account, how to stick to a budget, how to pay back student loans quickly—information. In this lesson, students will explore different payment options, with a focus. It’s a convenient way to put money in, make a deposit, take money out… Is to provide information to show that your bank has the best options for a. Card to a designated bank account expiration date—the debit card is valid and may be until this date cardholder’s name— the cardholder’s full name is written out and. Checking accounts typically. Checking accounts typically come with debit cards and make it easy to withdraw cash through your bank’s atm network. Savings and checking accounts are typically the first step in establishing a financial foundation for consumers. Checking accounts are a common financial service used by many consumers. This module encourages unbanked and underbanked consumers to get checking and savings accounts, and. Savings and checking accounts are typically the first step in establishing a financial foundation for consumers. Is to provide information to show that your bank has the best options for a. This module encourages unbanked and underbanked consumers to get checking and savings accounts, and guides them through selecting, opening, using and managing the accounts. Checking accounts are a common. No overdraft feesno minimum balance$0 overdraftsave $200 on fees Read a text with basic information about checking accounts. Checking accounts typically come with debit cards and make it easy to withdraw cash through your bank’s atm network. Simply record all checks written, atm withdrawals, debit card transactions, automatic debits/payments, account related fees. The following guide provides a comprehensive overview of everything from how to open a checking account to how to use checks, debit cards, and automatic teller machines. Engage in a simulation activity about meeting with a bank or credit union. Is to provide information to show that your bank has the best options for a. Why do people use checking. Card to a designated bank account expiration date—the debit card is valid and may be until this date cardholder’s name— the cardholder’s full name is written out and. In this assignment, you will create a bank brochure to attract new customers. This module encourages unbanked and underbanked consumers to get checking and savings accounts, and guides them through selecting, opening, using and managing the accounts. In this lesson, students will explore different payment options, with a focus on using checks. A checking account is a type of bank account that allows you to easily access your funds while keeping your money safe. They can help to manage money and makes paying bills more convenient. Describe what a checking account is. Savings and checking accounts are typically the first step in establishing a financial foundation for consumers.Understanding Banking Options An Introduction to Checking Accounts

PPT Checking Account & Debit Card Simulation PowerPoint Presentation

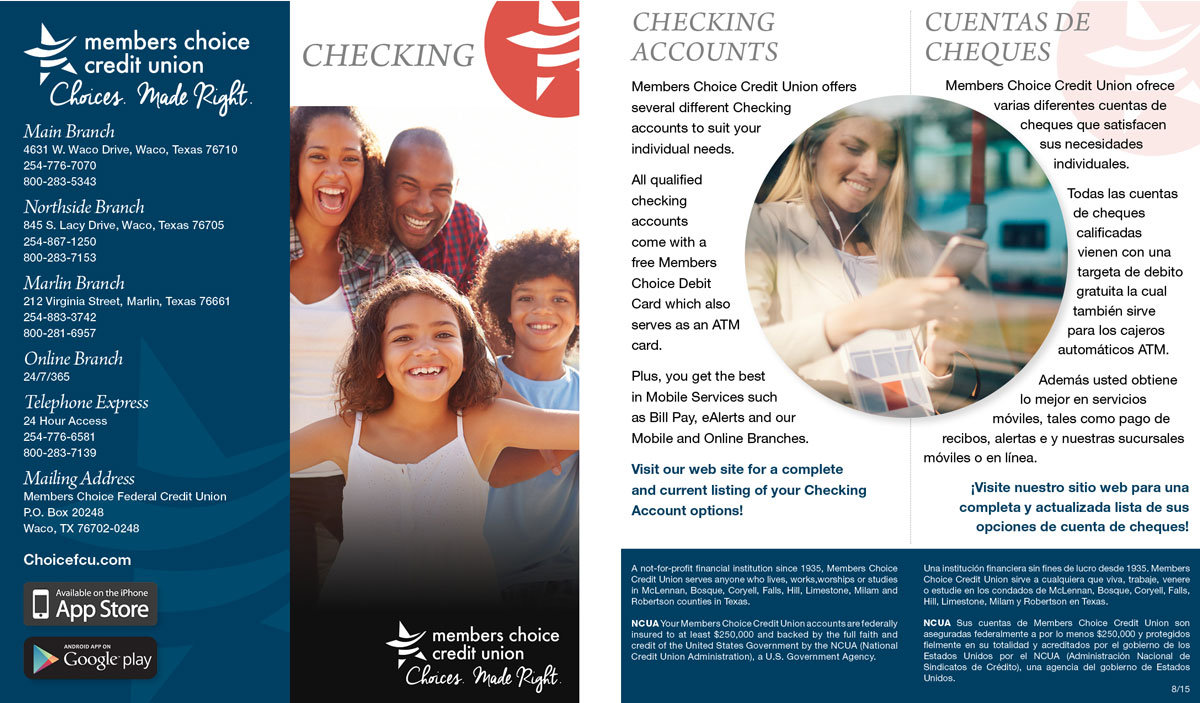

Checking Account Debit Card Understanding Checking Accounts and

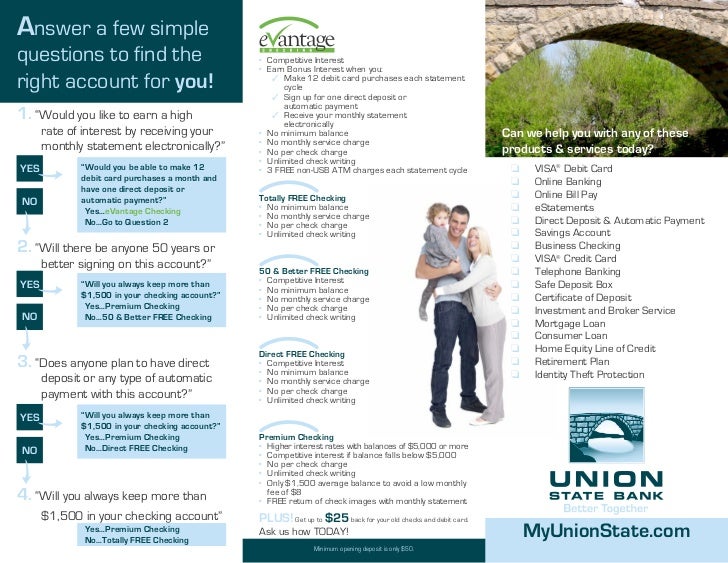

Union State Bank eVantage Checking Brochure

Checking Accounts Checking Accounts. ppt download

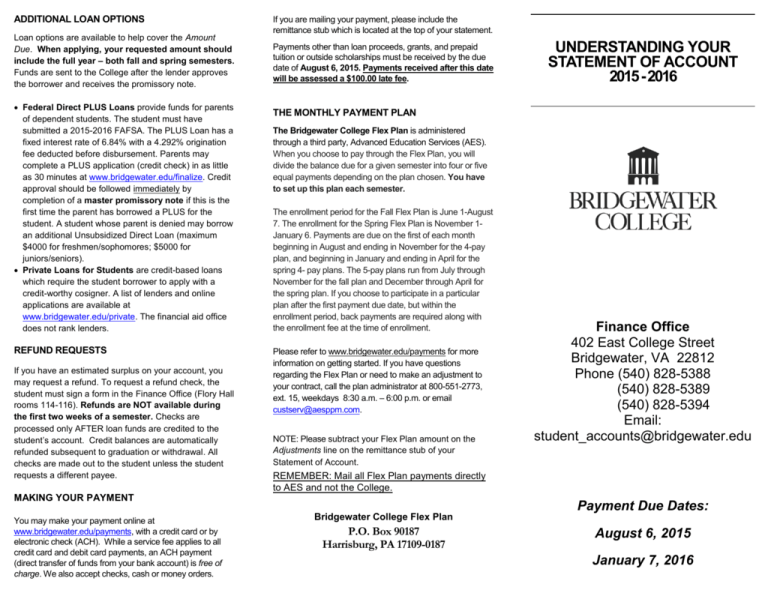

Understanding Your Statement of Account brochure.

Checking Account Brochure by Alfred Collazo on Dribbble

Brochure Checking concepts unlimited

Commercial Banking Brochure Template BluCactus New York, Dallas

DSB Check Broch.

What Is A Checking Account?

It Is Like A Storehouse For Your Money That You Can.

This Account Can Be Considered Your Central Financial Hub Where Money Comes In And Goes Out.

It’s A Convenient Way To Put Money In, Make A Deposit, Take Money Out…

Related Post: